The Warren Buffett Spreadsheet Tools are value investing tool collection will help you save time and money to get a more long-term perspective and become more disciplined, rational and patient investor.

These tools were made based on Warren Buffet Formula will give you the intrinsic value calculation in a stock you want and will save you a lot of time in your stock analysis.

DOWNLOAD BY CLICK THE LINK BEWLOW ( the link to download will send you your Facebook message)

Password unzip: kingtrader.net

If you found this useful, let me know in the comments below. If you found it super useful and want to thank me more, you can always just buy me a coffee ![]()

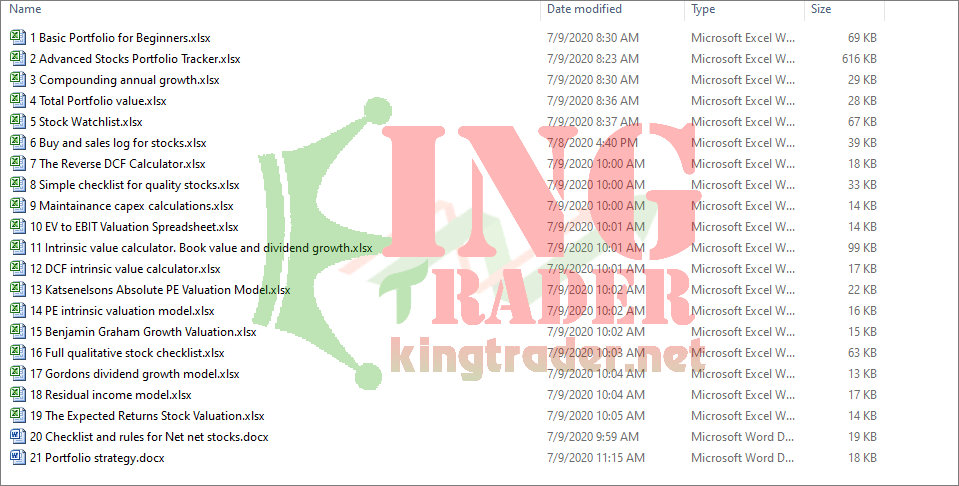

1. The Portfolio Manager

This is one of the best basic Portfolio Manager. Using formulas, Excel automatically pulls out real time data about stock prices. It also provides columns where BUY/SELL/HOLD analysts opinions from different outlets can be recorded. Finally, It is also included an evaluation formula which can be useful when deciding whether a stock is a good buying value related to an expected yearly return.

The WorkBook is comprised of 5 Sheets and was automated most of the data that is pulled in, manual input of certain fields is still required. It was highlighted such fields in green.

2. The Tool For Advanced Portfolio Stock Tracker

This spreadsheet portfolio manager only contains two sheets and a lot more fields are automated, meaning you have to input less data in order to get up to date figures.

I have highlighted the fields you will need to manually input in Yellow so it’s easy to build on it. I’ve also included the Gordon Growth Model Valuation tool as well a graph that shows portfolio diversity and a map that displays the HQ locations of your companies. I’ve only made it for my US Stocks but you can easily adapt it and customize it from here on. I’ve broken down the sections below.

3. The tool for compounding annual growth calculator

This tool let you see the magic of compounding and how important it is to start to save and invest early and how small differences in annual returns can have a huge influence of the total amount of money after a long time period.

4. The tool for total portfolio value

This tool lets you register your total portfolio value over time. There are benefits of doing this instead of focusing on individual stocks return. The benefits are mostly behavioral. It means that as long as the total portfolio value is increasing over time you are doing things right. We often can get too obsessed about each stock returns in the portfolio, and trade too much because of this. This tool keeps your perspective in order with your long-term goals and it is also good way to actually see for yourself that over longer periods of time there is usually a steady increase in the total value, even it sometimes don’t feel like it if we check our portfolio too often. I suggest you at maximum record the value of your portfolio once per month. Anything more is just noise for the long term investor.

5. The tool for free stock watch list

This tool was developed a stock watch list that can be used to save interesting stock that you have analyzed. You can also compare today’s price with the estimated intrinsic value and see your margin of safety. The data is provided from Google Finance and it is updated automatically as soon as you type in a stock ticker.

6. The tool for buy and sale log for your stocks

7. The tool for Reverse DCF Calculator

This calculator is useful, because unlike the normal DCF analysis that only estimates the intrinsic value based on future cash flow, this one let you see the growth rate that is expected by the stock market at the stock’s current price. You can then base on the expected growth rate make an judgement if you agree or disagree with the markets prediction. This can be easier than to judge whether the intrinsic value is really higher than the current stock price. It’s easier to judge whether the expected growth rate is fair considering the stocks historical growth rates.

8. The tool for portfolio strategy for value investors

This word file contains around 20 recommendations for portfolio construction and strategy. It is a synthesis of advice from the best long-term value investors coming from sources like books and interviews. Gives you a good framework for how you should be a good investor.

9. The Net Net stock checklist

This is probably the most comprehensive Net Net checklist that you will find online. It’s checklist points is gathered from books, online articles, and interviews. Especially from books and interviews of Jeroen Bos. The author of the book Deep Value Investing.

10. Simple checklist for high quality stocks

This is a simple checklist for quality stocks that covers the most important checklist items that you should be aware of before buying a stock. It covers checklist items that give you information about the moat, management, profitability, financial strength, valuation and sentiment of the company.

11. Bruce Greenwalds maintainance capex calculation tool

This is a spreadsheet that uses a simple formula to separate a company capex (capital expensitures) into maintainance capex and growth capex. We like to separate these so that we can see what it cost just to keep the business going (maintainance) and how much is used for growth, that can produce additional income for the company in the future. This spreadsheet can be used on stable and mature companies that does not have too high capex requirements.

12. The EV/EBIT Valuation Spreadsheet Tool

13. Intrinsic value calculator: Book value and dividend growth

14. The DCF intrinsic value calculator

This calculator estimate the intrinsic value of a stock based on the amount of free cash flow it will produce and the growth rate of these free cash flows in the future. This calculator works best for mature company that has a positive FCF the past 10 years and have stability in their FCF. This calculator does not work well for rapidly growing companies as these can be negative in FCF because all of the cash goes to future cash flow genereating investments.

15. Katsenelson’s Absoulte P/E Valuation Model

16. P/E Intrinsic Valuation Model

17. Benjamin Graham Growth Valuation Model

18. The full stock checklist for value investors

19. 2-Stage Gordon’s Dividend Growth Model

20. The Residual Income Model

21. The Expected Returns stock valuation model

DOWNLOAD BY CLICK THE LINK BEWLOW ( the link to download will send you your Facebook message)

Password unzip: kingtrader.net

If you found this useful, let me know in the comments below. If you found it super useful and want to thank me more, you can always just buy me a coffee ![]()

Note: If you can not download please contact us via FACABOOK SUPPORT on the bottom right.

Thanks you and hope you will have useful tool for your trading!

Great stuff. The book charts are far too small and I can zoom in on your website and read the book at the same time.

The download tools link isn’t there (on Chrome or Edge).

Please reinstate… happy to donate.

Thank you, I found this useful

Won’t able to download please send me the link to my email please

I sent it to your email! enjoy it

I Cant download the file Can you please share me the documents

I sent it to your email! enjoy it

I Cant download the file Can you please share me the documents …

Hello, please download here:

DOWNLOAD HERE

How can i get the password to open these excel spreadsheet templates

I already sent it to your email, please check and enjoy it

Thanks