FOREX AND FUTURES WHAT THE FOREX MARKET WILL BE?

The Foreign Exchange (FX) is one of the fastest-growing investment arenas today; large Institutional investors and Hedge funds are big players in the FOREX Markets and in the last three years the Foreign Exchange market has had estimated 50% increase in volume. Some had credited this increase to the large activity created by the Online Currency Trading for the retail investor. The FOREX Exchange market is an over the counter market, which means that there is no main Exchange or clearinghouse. This is contrary to the Futures Markets which offers Futures in “open outcry” or transparent pricing through a trading platform so one can see the bids/asks and size, otherwise known as the “depth of market” (dome).

In this course we will be looking at the different aspects of trading the currency markets, including the advantages and disadvantages of trading the FOREX markets. In addition, you will learn how to use other resources to make better decisions on when to enter or exit your FOREX positions.

Trading the FOREX offers leverage, leverage that the individual controls. Through the use of Margin, an individual investor has the choice to increase or decrease leverage through various means. Most currency firms offer 100 times leverage on a regular size account; compare this leverage to the leverage offered to the average equity investor and you can see why many traders are more attracted to trading the FOREX. As mentioned previously, leverage in the FOREX Markets can also be customized to the individual trader, which means that a trader can choose to lower or have no leverage while trading the FOREX.

FOREX THE CURRENCY CASH MACHINE

Foreign Exchange currency trading, otherwise known as the FOREX market, offers a completely different investment asset class that offers leverage and virtually unrestricted access twenty four hours a day. FOREX trades virtually around the clock from the Asian market open on Sunday night until the US market close on Friday afternoon. One of the attractions from an individual trader’s perspective is that there is this constant access to make a trade. Foreign Exchange is the simultaneous buying of one currency and selling of another.

In other words, in every transaction, a trader is long one currency and short the other. A position is expressed in terms of the first currency in the pair. For this reason, currencies are always traded in pairs; for example, if you have purchased Euro and sold US Dollars it would be state as a Euro/Dollar pair.

With a volume of over $1.5 trillion daily, the Foreign Exchange market is the largest & most liquid financial market in the world; this is more than three times the aggregate amount of the US Equity and Treasury markets combined. This means that a trader can enter or exit the market at will in almost any market condition with minimal execution risk. The FOREX market is so vast and has so many participants that no single entity, not even a central bank, can control the market price for an extended period of time. Unlike other financial markets, the FOREX market has no physical location, no central Exchange. It operates through an electronic network of banks, corporations and individuals, trading one currency for another. The lack of a physical Exchange enables the FOREX market to operate on a 24-hour basis, spanning from one zone to another across the major financial centers.

MARGIN AND LEVERAGE

The FOREX market allows traders to control massive amounts of leverage with minimal margin requirements; some firms offer as much as 100:1 leverage. For example, traders can control a $100,000 position with $1,000, or 1%.

Obviously, leverage can be a powerful tool for currency traders. While it does contribute to the risk of a given position, leverage is necessary in the FOREX market. This is because the average daily move of a major currency is about 1%, while a Stock typically sees much more substantial moves.

Leverage can be seen as a free short-term credit allowance, just as it is in the Futures markets, allowing traders to purchase an amount of currency exceeding that of their account balance. As a result, traders are exposed to an increased level of both risk and opportunity. Due to the nature of the leverage in the FOREX markets, positions are normally short lived. For this reason, entry and exit Points are crucial for success and must be based on various technical analysis tools. While fundamental analysis focuses on what should happen, technical analysis is based on what has or is happening at the current time.

Identifying the overall trend, whether it is short term or long term, is the most elementary element of trading with technical analysis. A weekly or monthly chart should be used to identify a longer-term trend, while a daily or intraday chart must be used for examining the shorter-term trend. After determining the direction of the market, it is important to identify the time horizon of potential trades and apply those strategies to the appropriate trend. Therefore the techniques covered in this course are highly effective in trading the FX markets.

Technical analysis is the study of historical prices in an attempt to predict future price movements. There are two basic components to which technical analysis is based on: prices and volume. With the proper understanding of how these two components exploit the impact of supply and demand in the marketplace, combined with a stronger understanding of how indicators work, especially when combining Candle Charts and Pivot Analysis, you will soon discover a powerful trading method to incorporate in the FOREX market.

LONG OR SHORT

If one wants to take advantage of a price decline, one of the advantages that the FOREX market has over equity markets is that there is no uptick rule as exists in the Stock market; short selling in FOREX is similar to that in the Futures market. By definition, when a trader goes short, he is selling a currency with the expectation that the price will drop, allowing for a profitable offset. If the market moves against the trader’s position, he will be forced to buy back the contract at a higher price, resulting in a loss on the trade. There is no limit to how high a currency can go, giving short sellers an unlimited loss scenario. Theoretically, a short seller is exposed to more risk than a trader with a long position; however through use of stop orders traders can mitigate their risk, regardless if long or short. It is imperative that traders are well disciplined, and execute previously planned trades as opposed to spontaneous triggers.

There are obvious benefits to short selling. This aspect of the FOREX market allows traders to profit from declining markets. The ease of selling contracts before buying first is in contrast to typical Stock trades. Market prices have a tendency to drop faster than they rise, giving short sellers an opportunity to capitalize on this phenomenon. Similarly, prices will often rally gradually with increasing volume. As prices begin to reach a peak, trading volume will typically taper off. This is a signal that many short sellers look for to initiate a trade.

When a reversal does occur, there will typically be more momentum than the corresponding up move. Volume will increase throughout the sell-off until the prices reach a Point in which sellers begin to back off.

There have been quite a few milestone memories from famous currency trades, both with short positions and long. Take for example when famed financier George Soros “broke” The Bank of England; he placed an estimated 10 billion dollar bet that the British Pound would lose value and he won the bet! How about Daimler Chrysler, the Parent company of Chrysler and Mercedes Benz; They reportedly made more money in the FOREX markets than they did selling cars! There were other reports, such as in early 2005, when Warren Buffet announced the Dollar was in trouble and he stated he was heavily Short the US currency; that did not turn out so well as the Dollar rallied for the most part, of all of 2005. What turned the market around? There were many issues, mainly political, geopolitical and economic developments that influenced the dollar’s value. For starters, many US based multi-conglomerate corporations were prompted to bring money back into the US due to the Homeland Investment Act. The HIA is part of 2004 American Jobs Creation Act and was intended to encourage U.S.- based companies to bring money back home.

The window of opportunity afforded by the HIA has prompted companies to increase the pace at which funds are repatriated to the U.S. Since companies had only until the end of 2005, many analysts suspected that companies would rush to repatriate foreign profits by year’s end, and then there would be a high dollar demand to convert Foreign Currencies. During the middle of the year, don’t forget we had riots in France, which contributed to poor market sentiment toward the euro zone, thus giving ground for a flight to safety, and helped foreign investors switch to buy US Dollars.

The tone was essentially dollar-positive and euro-negative, which is indicative of politics having a negative effect on the euro. Meanwhile, the broader market was also most likely influenced by the high-profile move by Berkshire Hathaway Inc.’s Warren Buffett to cut back speculative positions against the U.S. Dollar after losing big due to surprising dollar Strength.

Mr. Buffett had bet that the dollar would continue losing ground, as it did in 2004, as he felt the massive U.S current-account deficit would be dollar negative. Instead, monetary policy dictated otherwise as the Federal Reserve continued to raise interest rates. That was helping to drive demand as the interest rate differentials widened. In its 3rd quarter report in 2005, Berkshire Hathaway said it had cut its Foreign-currency exposure to $16.5 billion from $21.5 billion in June.

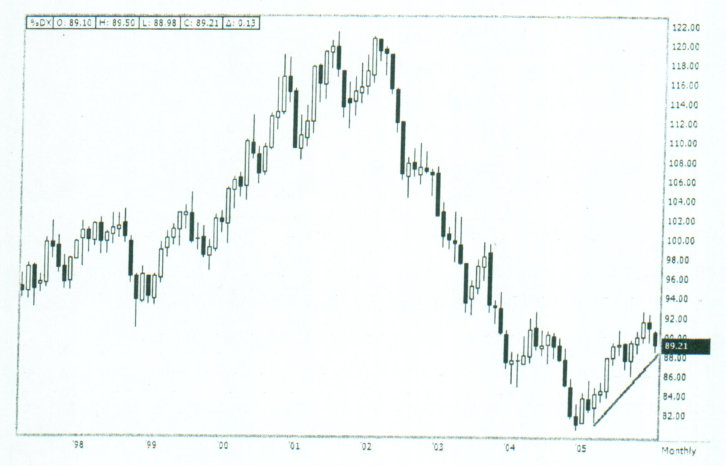

As you can see from the Dollar Index weekly chart in figure 1, on a year to year basis, the Dollar did make an outstanding run. However keep in mind the Dollar was at a high of 120.80 back in 2002, so depending on where Warren was shorting the Dollar, he could still be in a lucrative or profitable position. The focus of this example is how shifts in monetary and fiscal policies can and do dictate price swings in the market, as happened in 2005.

FOREX trading is considered the juggernaut in the investment world with more than 3.5 trillion in currency trading taking place per day, according to the Bank for International Settlement. There is more daily volume in the FOREX market than in all of the US Stock markets combined. There is no doubt that is one reason why Foreign Currency has become so popular; the market has liquidity, and has favorable trading applications such as the ability to go long or short a position. These are some of the reasons why Forex Trading attracts so many individual investors; Besides, it trends and trades well based off of Technical Analysis studies.

In the past, currency trading was accessible for speculators through the Futures industry when the central market place in the banking arena was for the privileged few. This has all changed now and the competition is fierce. The industry has expanded from what was an exclusive club of proprietary traders and banks, to now where any and all individual traders who want to participate have access in this 24-hour market from their home or office computers or laptops.

The FOREX markets offers traders free commissions, no Exchange fees, on-line access and plenty of liquidity. Unlike the Futures products, the Forex markets use standardized contract values, meaning full size positions are valued at 100,000.

The one main element that has attracted Investors was and is the commission free trading aspect. Plus, most FOREX Firms require less capital to initiate a start up account than for a Futures account. In fact, investors can open accounts on their debit and or credit cards and still today the practice exists of accepting online payments through Pay Pal.

Some firms offer smaller size “flexi-accounts” allowing traders to start applying their skills at technical analysis with as little as 500 dollars and trading ultra mini size accounts with leverage. This feature is known as a mini-Account; it allows individual investors to adjust their positions by not having too big of a contract value per position, as one can add or scale into more or fewer positions to adjust the level of leverage according to their account size. This means that smaller size investors are not excluded from trading by participating with mini size contracts. What is great about this feature is that a new trader or an experienced trader who is testing a system can trade the market with real money, rather than simply paper trading; the new traders can benefit from the actual experience of working out execution issues and more importantly, will be able to see how they handle the mental aspect or the emotional side of trading. Having real money on the line certainly helps teach people to learn about their emotional make up. This is one great way to overcome the fear and greed syndrome which many traders seem to battle. Another excellent quality that FOREX Mini-accounts have is that smaller size traders can afford to trade multiple positions for scaling out of positions in order to let a portion of the position ride a profitable position, while capturing profits on a partial exit. You and I will go over more on that style of trading later.

Another attraction is that most FOREX companies offer free real time News, Charts and Quotes with state of the art order entry platforms; some even have automated order entry features such as One Cancels the Other and trailing

stops. All of these tools and order entry platforms come at no additional charges to the trader.

These features may sound too good to be true with all the benefits the FOREX market offers; most newcomers want to know what the catch is. This is a good Point; there really are no catches except for some slight cost factors which relates to execution. You pay a premium, or a higher spread, to buy and a higher spread to sell. Another catch is most FOREX companies take the other side of your trade. You do not have direct access to the Interbank market as it is called. Since the FOREX market is decentralized, it is possible that five different companies are showing five different prices all at the same time within a few Points or “PIPs” as they called. Most FOREX traders are short term in nature meaning they are quick in and out players; day trading in the FOREX markets is beneficial for these types of traders due to the fact that there are no commissions, but the PIP spreads can and do add up. Therein lies the catch.

BUY AND SELL THE SPREAD

FOREX prices, or quotes, include a “Bid” and “Ask” similar to other financial products. The Bid is the price at which a Dealer is willing to buy and traders can sell a currency and the Ask is the price at which a Dealer is willing to sell and traders can Buy a currency. In FOREX trading, unlike Futures or equities, one has to pay a PIP (Points) spread on entering and on exiting a trade. The PIP spread is the Point difference between the bid and the asking price of the spot currency price. This can vary between 3 and 6 PIP’s or Points.

If you want to hold a position for several days, a “rollover” process is necessary. In the spot FOREX market all trades must be settled with in two business days at the close of business at 5 PM (EST). The only fee involved here is the interest payment on the position of currency held. At times, depending on the position,

one can receive an interest payment as well. This is where the term “Tomorrow/ Next” (Tom/Next) applies. It refers to the simultaneous buying and selling of a currency for delivery the following day.

As with Futures, FOREX markets are now regulated to an extent and come under the scrutiny of the self imposed regulators, such as the National Futures Association after the CFTC Modernization Act passed in 2002, but since there is no centralized market place, many FOREX dealers can and do make their own markets as discussed earlier.

WHY TRADE SPOT FOREX MARKETS

There are many financial instruments available to traders; however, many professional traders and analysts believe for a number of reasons that FOREX is one of the best markets to trade. First is because of its sheer size in trading volume; according to the Bank for International Settlements, average daily turnover in traditional Foreign Exchange markets amounted to $1.9 trillion in the cash Exchange market and another $1.2 trillion per day in the over-the-counter (OTC) Foreign Exchange and interest rate derivatives market as of April 2005. Second, the rate of growth and market participants in FOREX trading has grown some 2000% over the last three decades, rising from barely $1 billion per day in 1974 to an estimated $2 trillion by 2005. Third, since the market does not have an official closing time period, there is never a backlog or “pool’ of client orders parked overnight that may cause a severe reaction to news stories hitting the market at the US Bank opening. This generally reduces the chance for price gaps. Currencies tend to experience longer-lasting trending market conditions than other markets. These trends can last for months, or even years, as most central banks do not switch interest rate policies every other day. This makes them ideal markets for trend trading and even breakout systems traders. This might explain why chart pattern analysis works so well in FOREX trading. With

such widespread groups playing the game around the world, crowd behavior plays a large part in currency moves, and it is this crowd behavior that is the foundation for the myriad of technical analysis tools and techniques. Due in part to its size, FOREX is less volatile than other markets. Lower volatility equals lower risk. For example, the S&P 500 Index trading range is between 4% and 5% daily, while the daily volatility range in the Euro is around 1%.

Trading veterans know that markets are interdependent, with some markets more heavily influenced by certain markets than others. We covered some of these relationships looking at Futures and certain Stocks and how interest rates move equity markets and currencies. We will learn in coming sections how to detect hidden, yet repeating patterns that occur between these related markets. FOREX is the ideal market for the experienced trader who has paid his or her “trading tuition” in other markets. FOREX is by far the largest market in dollar volume, is less volatile, experiences longer, more accentuated price trends and does not have trading commissions.

However, there are no free lunches. Traders must use all the trading tools at their disposal; the better these fundamental and technical tools, the greater their chance for trading success. While Intermarket and other relationships are often complex and difficult to apply effectively, with a little high-tech help, traders and investors can enjoy the benefits of using them without having to scrap their existing trading methods.

FOREX VS FUTURES: Futures Market

The Futures market through the IMM of the Chicago Mercantile Exchange has many benefits as well. Some believe there are tighter “spreads” between the bid and Asking price, plus there is no interest charge or rollover fee every other day.

In addition, the Futures markets offer options for longer-term traders. There are transactions costs that apply per round turn, but if the brokerage commission Exchange, regulatory and transaction charges are less than the PIP Spread in FOREX, an active speculator would be given a better cost advantage using the Futures markets instead of the FOREX SPOT markets.

For example, let’s compare a trade in FOREX on a similar size contract value as that on the Futures Exchange. Using the example of a Euro Futures contract on the CME where it has a contract size of 125,000 US worth Euros, where each tick or PIP would be 12.50 in value. If the commissions and related fees are $20, which is the average charge by most brokerage firms, that is your transaction cost per round turn. That is 10 dollars to buy and 10 dollars to sell out the position. Keep in mind the contract value is 25 percent higher than a full size FOREX position too. If a day trader in FOREX trader in a 100,000 full lot size contract pays 3 PIPS on every transaction both on the entry and exit of a position, this trader would be charged 60 dollars per round turn transaction (30 + 30 = 60).

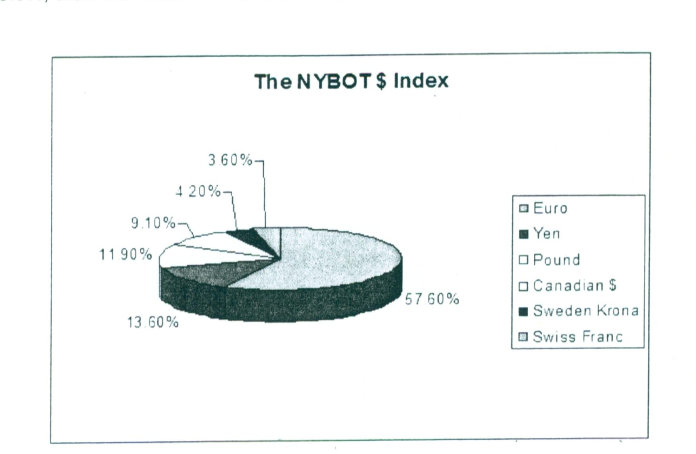

The Futures arena also has other interesting features and products, one is the U.S. Dollar Index® contract traded on the New York Board of Trade. It is computed using a trade-weighted geometric average of six currencies. It virtually trades around the clock, the Trading Hours: are from 7:00 p.m. to 10:00p.m. Then from 3:00 a.m. to 8:05 a.m. and then it reopens from 8:05 a.m. to 3:00 p.m. Unlike the FOREX, there are Daily Limits on the Price Movement, with 200 ticks above and below the prior day’s settlement, except during last 30 minutes of any trading session, when no limit applies. Should the price reach the limit and remain within 100 ticks of the limit for 15 minutes, new limits will be established 200 ticks above and below the previous price limit.

The chart below in Figure 2 shows a breakdown of the various currencies and their respected weights on the average. The top four include the Euro Currency, which is the heaviest weight with 57.6%, then followed by the Japanese Yen with 13.6%, then the British Pound with 11.90% and the Canadian Dollar with 9.10%.

ANALYTICALLY SPEAKING FOREX IS BETTER

From an analytical Point of view, FOREX trading is a much more simplified trading vehicle when compared to the Futures products. One reason is due to the uniformed contract sizes in the FOREX markets. The tick or PIP value varies in the Futures products based on the contract and sizes of the various markets; The Euro is $12.50 per Point, the Canadian Dollar is $10 dollars per Point and the British Pound is $6.25 per Point. The Yen is 12.50 per Point, but it is quoted inversely to the cash market.

The Futures would be quoted at .8485 when the cash or spot FOREX would be bid at 117.90 and offered at 117.94. This leads me to my next Point on why trading the FOREX markets have a tremendous benefit. FOREX traders do not have to deal with what is known as “roll-over”. Every Quarter in the Futures markets there is an expiration of the contracts. The rollover period takes place on the second week every June, September, December and March. It is at that time you need to convert or roll out of the old contract month and then into the new month or next expiration contract going forward. The First Notice day and Last Trading day combined with the Options expirations can hinder trading and cause confusion; there are situations where at times traders place orders for the wrong contract months during this “switching period”.

If you are calculating Pivot Points, you need to constantly switch your analysis from the expiring contract to the new contract month. This can cause “gaps” in your analysis. Take for example the roll-over that occurred in March of 2006. On March 7th’ the March Futures contract was still trading and was quoted at .8485. The June Futures contract had become the lead month and was quoted at .8597. That would mean that there was a ‘gap” of over 100 pips due to what is called the bases, which is the difference between the cash market today and the Futures contract for delivery in June. The basis includes what is known as the carrying costs.

As a trader, I would need to adjust my numbers and analysis for this gap or start back tracking prior sessions to accommodate for the price differences. It is done every Quarter and believe me, it is a royal pain. So not only do you have to be careful placing the right contract, you need to know the various margin requirements, the right expiration dates, contract values, and the value of each tick or point. You could also mix up and place the wrong contract month when placing orders.

For example, if you bought a June Euro Currency in the morning and were in a rush to exit a trade and in your attempt to offset the trade, you sold a March contract because you had been trading the March contract every day for the last three months, you have made a mistake common to many traders. Actually, you did not offset the original position; instead, you now hold two positions in two different contract months. So that is how errors can and do occur. In FOREX markets that scenario does not exist. You have no down time or additional work when trading FOREX, as rollovers do not exist. It is a continual market place.

Leave a Reply