INSIDER TRADING INFORMATION: Commitment of Traders Report.

There is one more piece of information that Spot FOREX Currency traders can “Borrow” from the Futures Industry; It is the Weekly Commodity Futures Trading Commissions Commitment of Traders report. The primary purpose for this report is to monitor and have a tight surveillance program in order to identify situations that might pose a threat of a market or price manipulation, and therefore allow traders to take appropriate action. The CFTC market surveillance staff closely monitors trading activity in the Futures markets in order to detect and prevent instances of potential price manipulation. Some consider this “insider trading” information because every week we get to take a look at which investor group is taking which side of a trade. There are many studies and books written on the subject. In fact, it was covered in my first book on pages 162 -165. As a veteran trader for over 26 years, I have used this information to capture many significant moves in the markets as well.

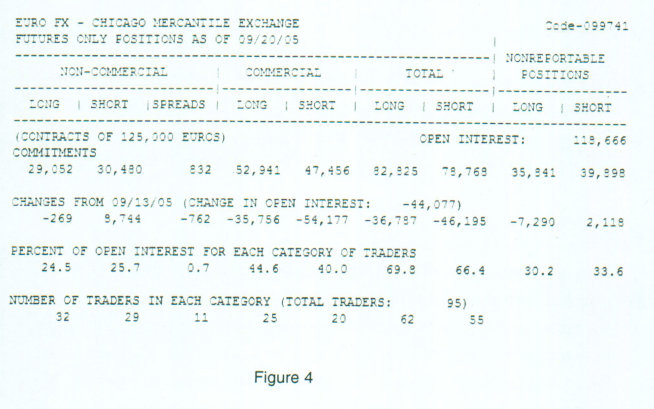

In the sample as shown in the table in figure 4 there are several categories. The first is the “non-commercial” that lists all large professional traders or entities such as hedge funds, commodity trading advisors, commodity pool operators, and locals on and off the Exchange floors. It includes any trading entity that hits a reportable position limit; for instance in the CME currencies, at the end of 2005, it was 400 contracts.

The next category of importance is the Commercials: banks and institutions or multi national conglomerate corporations looking to hedge a cash position. The long and short open interest shown as “non-reportable positions” is derived by subtracting total long and short “reportable positions” from the total open interest. Accordingly, for “non-reportable positions,” the number of traders involved and the commercial/non-commercial classification of each trader are unknown. This balance of positions is assumed to be the small speculators. If you look at the

first column under non-commercials, it shows the break down of how many long positions versus short positions are held. The next line down shows the changes from the prior week. This is important information because you will be able to see if these guys unloaded some of their positions or added to them from one week to the next. The line under that tells you what the percentage of long and shorts is held and the last line shows how many traders there are that control longs or shorts. The information is gathered as of the close of business every Tuesday by each of the Clearing Brokerage firms and turned over to Exchange officials, who then report the information over to the Regulatory body know as the C.F.T.C. This information is released on Friday afternoons at 3:30PM (ET). Before acting on a decision based on this information, it is critical to know if there was a major price swing from Tuesday’s close to the time the information was released because positions may have changed hands.

CAN TRADERS BENEFIT AND MAKE MONEY FROM THIS INFORMATION?

The answer to that is, there is always a chance to make money; the key is to be able to afford not to be too heavily leveraged if the market moves further than anticipated. This report is like an insider information report. It acts like a true consensus of who literally “owns” the market. A FOREX trader can use this data to determine if market participants are too heavily positioned on one side of the market in a long term trend run. It is generally the small speculator who is left holding the bag. I mean, let’s face it, money moves the market and the Banks and large professional traders are a bit savvier when it comes to their business. After all, one would think a bank has a good idea of what direction interest rates are going to go once a Central Bank meeting occurs, right? Suppose the small speculators are showing a nice short position, of say, at least two longs for every one short. If the non commercials are net long and the Commercials are net long, chances are the small speculators will be wrong. I am looking for imbalances in markets that have been in a trending market condition for quite some time and therefore I can develop a game plane and start looking for timing clues to enter trades accordingly. Keep in mind the commercials can and sometimes are not right, they are not in the market to time market turns. They are hedging their risk exposure in a cash position. Therefore the non-commercials, or professional speculators, in the short term, are considered the smart money. Here are some general guidelines to follow:

- If non commercials are net long, Commercials are net Long and the non reportable positions category are net short by at least a two to one margin, look at buying opportunities. In other words go with the pros.

- If non commercials are net short, Commercials are net short and the non reportable positions category are net long by at least two to one margin, look at buying opportunities.

- If non commercials are net long, Commercials are net short and the non reportable positions category is neutral, meaning not heavily net long or short, look at buying opportunities, and stick with the smart money.

WHAT EVENTS MOVES THE CURRENCY MARKETS?

Traders need to be aware of several key elements and events that are at hand that can cause currency values to move. For one, Intervention plays a role in the currencies. When the Bank of Japan felt threatened that their export business would suffer at the hand of an overvalued Yen, they would intervene and sell Yen to buy US Dollars. Countries like Canada and Australia, which produce raw commodities, saw a rise in their currency valuations as global demand increased for their goods and as their economies improved as well.

Foreign Currency markets are mainly influenced by international trade flows and investment flows, which are the same factors that influence the equity and bond markets:

- Economic and political conditions.

- Interest rates, inflation, and political instability.

These factors have a long-term impact, which makes FOREX attractive to trade due to the long term trending conditions established by central bank decisions based on these factors. FOREX also offers investors some diversification necessary as protection against adverse movements in the equity and bond markets.

STUDY THE “MACRO” ISSUES

Traders who are new to FOREX can take comfort in knowing that analyzing and forecasting Exchange rate movement relies solely on macro-economic factors: the “big picture” issues, concepts for which information is readily available and intuitively grasped. Once traders have an understanding of the big picture pertaining to an economic region, they can place trades in the currency market to profit from their analysis. Currency traders who are looking to capture big moves in Exchange rate movement definitely should focus on three issues when attempting to assess the value of currencies:

INTEREST RATES

Each Foreign currency has a central bank that issues an overnight lending rate. This is a prime gauge of a currency’s value. In recent history, low interest rates have resulted in the devaluation of a currency. Many analysts assume this is a function of the carry-trade strategy, employed by many hedge funds. This is a trade where one buys and holds currencies in a high yielding interest rate market such as the United States and sells or borrows money from a foreign country where the currency is in a low yielding interest rate market like what exists in Japan. There is a significant risk exposure to this investment which requires large capital, or a highly leveraged position from an Exchange rate fluctuation.

UNEMPLOYMENT RATE

The unemployment rate is a strong indicator of a country’s economic strength. When unemployment is high, the economy may be weak and hence, its currency may fall in value. The opposite is true as well. Many economists look for answers to the question: What is a country’s full employment capacity level? That

knowledge will give clues to the peak in Productivity and economic output. That also helps determine a country’s capital flows and is therefore, good information for currency traders to follow for longer term trend identification.

GEOPOLITICAL EVENTS

Like all markets, the currency market is affected by what is going on in the world. Key political events around the world can have a big impact on an economy and the value of its respective currency. Turmoil, strikes, and terrorist attacks as we have witnessed in the new millennium, all play havoc and cause short term price shocks in the currency markets. We have heard the term flight to safety, indicating that traders are moving money from one country to another, thereby, causing shifts in currency values. These events need to be monitored by FOREX traders as well.

FOREX traders use Fundamental analysis as described above to identify trading opportunities by analyzing economic information for a longer term perspective. Short term traders should also understand what reports can cause a shift in currency markets and know when they are released. Knowing the best times to trade the markets will help you nail down when a potential trade may materialize. The Pie chart in figure 2 showed the largest percentage value traded against the US Dollar was the Euro Currency, and therefore, that would represent the European Session. The central place of Foreign Currency Dealings is in London where the second most active trading volume occurs. Therefore, it is where there are likely to be large range swings in the market granting day traders an opportunity to profit. That session begins at 2 AM (ET) until 11 AM (ET) so a Euro currency to US Dollar (EU/USD) or Euro Currency to British Pound (EU/ BP) or British Pound to US Dollar (BP/USD) would be an appropriate pair selection to trade.

The US session opens at 8 AM (ET) which overlaps the European session; these two sessions combined generate the bulk of trading activity. Most major US Economic reports are released at 8:30 AM (ET), and as expected, the currency markets generally react off those reports. This offers traders the opportunity to trade off of what is normally a violent price spike. Once the US Markets close at 5 PM (ET), the currency markets are available to trade, but it is not until the Asian session that opens at 7 pm (ET) that markets will experience potential price swings.

During the Asian session, traders should focus on the Australian dollar and Japanese Yen, looking for opportunities offered by the USD/JY or the USD/ AUS or the cross pair trading the JY/ AUS dollar. Notice that the Asian markets overlap the European session as well, so Japanese Yen versus Euro Currency cross (JY/EU) is a popular pair to trade as well. Here are the time zones one wants to focus on when trading spot FOREX markets.

- European Session 2 AM (ET) until 12 PM (ET)

- US Session 8 AM (ET) until 5 PM (ET)

- Asian Session 7 PM (ET) until 4 AM (ET)

The prime time trading periods for day traders are from 1:30 AM ET until 5:30 AM (ET) then from 7 AM (ET) until 12 PM (ET) and then from 1:30 PM until 5 PM (ET). This is when peak volumes occur, due to the opening of the European session and economic reporting times in Europe. Then as the US market opens you have the window of opportunity to trade off the volatility from the time when US reports are released. Then in the afternoon of the US session, volume increases as traders rush to balance their positions before the end of the day. These are the select times to trade FOREX markets.

For the most part, day and swing traders use technical analysis to identify opportunities from specific chart patterns that demonstrate frequent re-occurring results. They need to trade in active time periods, using trend lines and moving averages, both which are a form of trend line analysis; these will help in certain market conditions. We will go over a different set of moving averages than what is normally written about; this will help identify conditional changes in the market, thereby giving FOREX traders a better edge. We will also incorporate and show you how to calculate support and resistance levels from mathematically based models such as Pivot Point Analysis and other means such as Fibonacci corrections and extensions, to identify opportunities and drive trading decisions. These are the methods I will be covering in this course to help you form a trading plan based on specific rules and conditions for trading the FOREX markets.

Leave a Reply